Image Credit: Propmodo

By Alyson Lundstrom

Why fast track your solar project with financing? Adding solar arrays to your commercial project adds infinite value to your building portfolio. Transitioning to renewable energy gives a breadth of benefits, including increased property values, ensures compliance green buildings certifications, allows for the redistribution of operational expenses, and for projects to meet net-zero goals.

The solar revolution is well underway. Renewable energy in the global economy is driving a bottom-line transformation where environmental and economic benefits are nearly instantaneous and only increase over time. Switching to commercial solar energy provides impact the moment it goes online. However, the entry cost can be intimidating depending on the scope of your needs and priorities for renewable power generation.

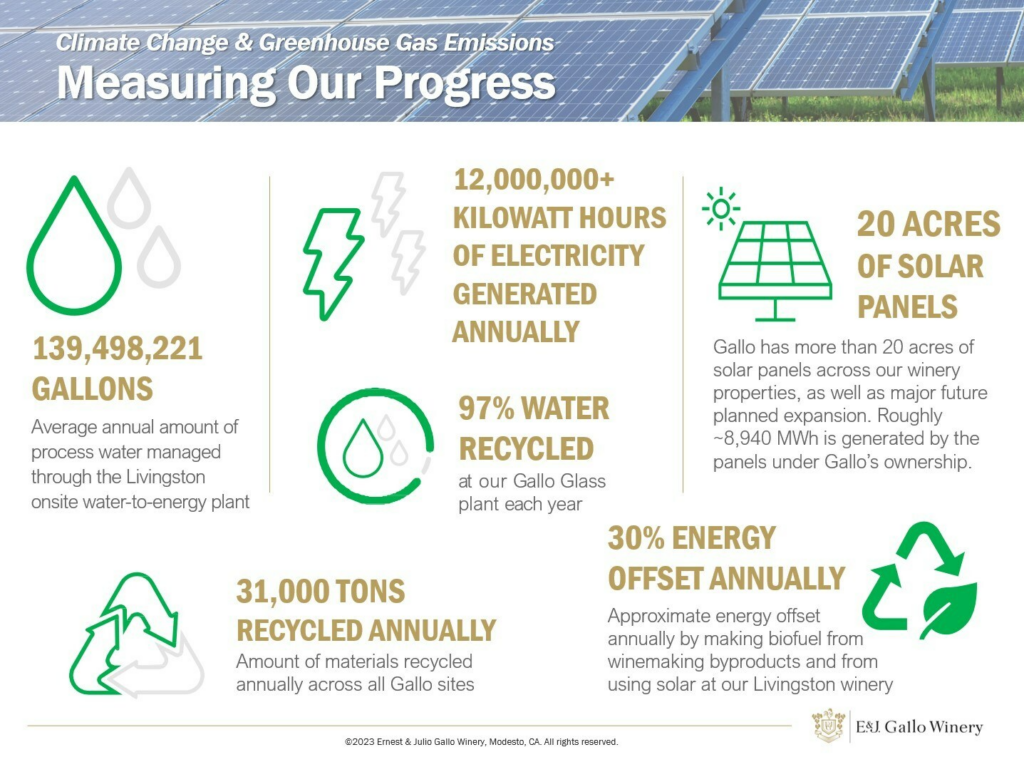

E. & J. GALLO WINERY demonstrating sustainable leadership with an ESG Progress Report highlighting the positive impacts of renewable energy.

The Benefits of Investing in Commercial Solar

The benefits of converting to commercial solar can be easily measured across the value chain. Environmental regulations, mandatory ESG disclosures, and economic incentives all benefit from a switch to the renewable energy grid.

Mandatory Sustainability Disclosures

Newly proposed SEC amendments would require public companies to disclose climate-related financial and emissions insights; switching to renewable energy makes a company not just prudent but future-ready. A switch to solar provides a tangible, quantifiable green asset to balance emissions within a company portfolio and meet sustainability targets.

Demonstration of Commitment

In addition, implementing renewable green assets provides a highly visible commitment to responsible business practices. Renewable energy impact is also a valuable metric to present to stakeholders. A conscious shift towards renewable energy shows an actionable measure to meet key ESG goals for future-proofing and green investment.

The Triple Bottom Line

One key benefit of meeting a triple bottom line with solar installation is the economic savings seen from lower energy costs, tax credits, and the ability to skirt the volatile fossil fuel market pricing in the future. While materials, installation, and maintenance of solar grids have historically taken long periods to break even in operation, kilowatt hours have dropped 13% since 2020, with around two-thirds of renewables installed last year besting the lowest-cost fossil fuels options.

Although the break-even point is coming closer, and the return on investment is solid, many companies will still need to finance a solar installation as the government, global climate goals and consumers demand a lighter carbon footprint.

Financing Options For Commercial Solar

The return on investment of solar over traditional fossil fuel power has been well documented. Once you have determined your project’s goals and calculated, There are multiple avenues to finance commercial solar projects. Ultimately, there are many ways to fund a path of renewable energy without the need for upfront capital.

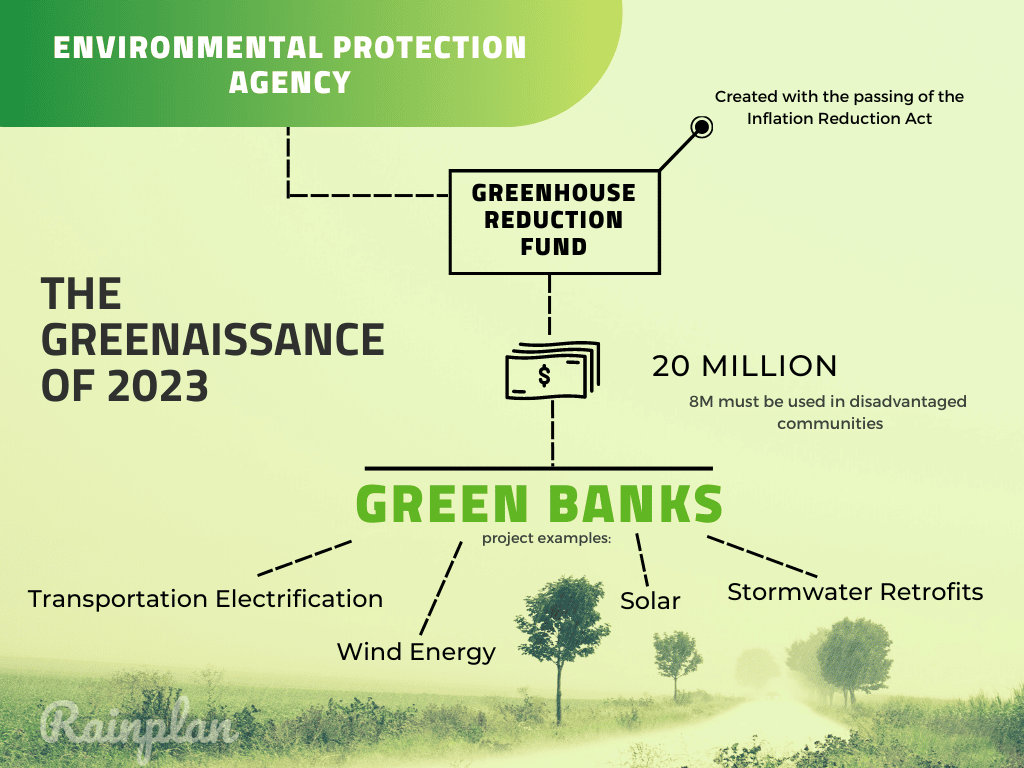

Image Credit: Rainplan

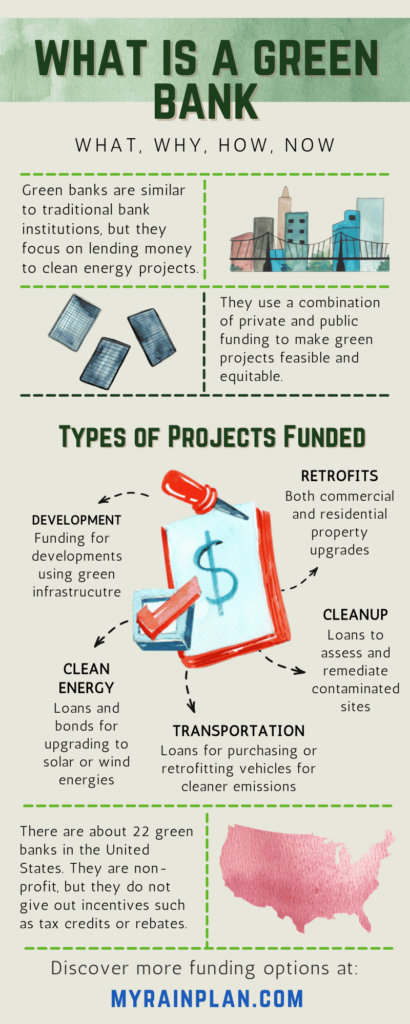

Green Bank Loan

Many banks and lending institutions offer preferable rates for loans that include paybacks for opting for energy-efficient power strategies. Ask your lender about opportunities to save on your terms with green incentives. Green banks and private lenders, in particular, are excellent options for low-interest ESG-linked loans.

Choosing a financier whose mission aligns with your company’s is paramount. Green banks don’t just finance energy efficiency infrastructure in building projects; they also maintain and contract users at a fixed price, allowing for “turn-key” solar development.

They are just as committed to their own sustainability goals as they are to yours. Many are certified B Corp companies, holding third-party certification, which holds them to the highest standards of verified transparency, environmental performance, and supply chain accountability..

US Green Banks:

- NY Green Bank

- Michigan Saves

- California Lending for Energy and Environmental Needs

- Rhode Island Infrastructure Bank

- Montgomery County Green Bank (Maryland)

- Hawaii Green Energy Market Securitization

- Nevada Clean Energy Fund

- Solar Energy and Loan Fund

- Energize Delaware

Image credit: CT Green Bank

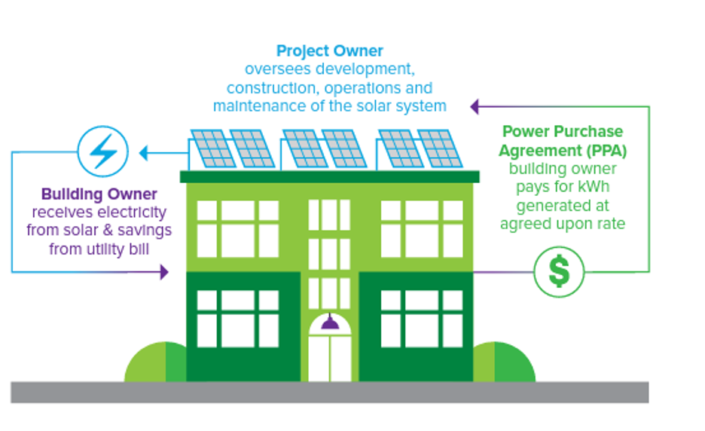

Lease or Power Purchase Agreement

A commercial solar Power Purchase Agreement (PPA) allows users to dive right into renewable energy without the out-of-pocket costs. Utilizing a PPA puts the design, development, installation, and maintenance of a solar system on the energy contractor. The commercial customer then pays directly to the solar company instead of towards a utility bill, which generally offers a lower rate than the local utility company.

Solar leasing similarly requires no upfront costs for equipment and installation. Instead, commercial customers pay a fixed monthly fee, which can be more cost-effective than the per kilowatt pricing that a PPA offers. However, because the system is leased, they do not reap the benefits of tax incentive programs.

Energy Service Agreements

An Energy Service Agreement (ESA) may be a suitable solution for a company that wants multiple property retrofits or one that is in a risk-averse period of growth. An ESA is a performance-based financing mechanism that is off the balance sheet and allows companies to implement energy efficiency projects with zero upfront capital.

With an ESA, the provider pays for all project development and construction costs, and once a project is operational, the customer makes service charge payments for actual realized savings.

Because payments are set at or below a customer’s existing utility price and result in immediately reduced operating expenses, ESAs offer promises for large-scale energy retrofits because they limit risk while still providing an avenue for short-term utility savings.

Government Assistance

Installing a solar project is a large step towards greater global net zero goals, and many federal governments, state agencies, and local entities offer incentives to reduce the barrier of entry for corporations and domestic homeowners.

ITC Tax Credits

The Federal Solar Investment Tax Credit (ITC) has been around since 2006, offering a direct dollar-for-dollar reimbursement to drive down the upfront costs of installation. Solar PV Systems will be eligible for a 26% tax credit by 2021, with Congress voting to increase the credit to 30% for installations between 2022 and 2032. This covers solar projects paid by cash, loans, financed installations, or PPA frameworks.

Inflation Reduction Act Extension of Benefits

In addition, the Inflation Reduction Act extended the solar tax benefits timeframe from 2022 to 2034. In particular, this extended several important provisions in the act. The 45L Energy Efficient Home Credit extended tax credits for investors and builders of low-income housing. In addition, the 179D Energy Efficient Commercial Building Deduction will now include qualified retrofits and remove lifetime limits on deduction claims. Both show the government’s support of the economy actively participating in net zero goals.

Rebates

A solar rebate involves the partial refund of a solar system investment which is returned to the owner after purchase. Typically, this consists of buying the system from a solar vendor and then filing for a rebate with the utility company, local government, or other organizations running the rebate program.

However, rebates can be limited in scope; for example, you may have to install in a certain region, use a preferred partner, and meet system specifications to be eligible.

Solar Is The Present, Not The Future

The Solar Energy Industries Association estimates that in 2021, 46% of all new electricity added to the United States grid was solar. There forecast shows that commercial solar projects are slated to double over the next five years with increasing tax incentives and lowering costs. Now is the time to schedule a transition to renewable solar energy.

Funding a solar project doesn’t have to be stressful. Greentech United can help you secure financing for your next renewable energy project.